|

February 2017 | Issue No. 20

Connect

|

|

If they had a billion dollars...

If you have ever heard the Barenaked Ladies’ whimsical tune, “If I had a million dollars,” it probably took you back to your childhood, when a million dollars was shorthand for a fortune that would let you buy everything that grown-ups wouldn’t.

While a million dollars may no longer suggest the same limitless possibilities, a billion dollars can still make most of us sit up and take notice.

Most Canadians would, therefore, be quite shocked to learn that every year over $1 billion of income benefits and tax credits that parliament has legislated for the needs of the most vulnerable people in Canada never make it into their pockets. Instead, the funds are rolled back into federal coffers or repurposed for other ends.

Read |

|

|

What's New

|

|

Breaking down barriers to tax filing for people living on low incomes

Canadians with low incomes are missing out on important income boosting opportunities because they do not tax file. Prosper Canada surveyed over 300 practitioners and experts who work with people living on low incomes to find out why. View highlights.

Read |

|

|

|

|

Be part of a tax research study to remove barriers to tax filing

Prosper Canada is working to better understand the financial lives of Canadian families as they tax file and claim government benefits. Be part of our Financial diaries: Tax time study from March to August 2017. Please share this opportunity with your clients.

Read |

|

|

|

|

Launch of new online tool to help evaluate financial literacy programs in Canada

Prosper Canada, the Canadian Bankers Association (CBA) and the Financial Consumer Agency of Canada (FCAC) have launched an online tool to help organizations evaluate their financial literacy programs.

Read |

|

|

|

|

2017 Federal budget proposal

We are recommending that the federal government invest $2M annually over five years to develop and execute targeted community outreach and support strategies that will enable Canadians with low incomes to access at least $100M in benefits they are currently eligible for, but not receiving.

Read |

|

|

| Learn about Financial Empowerment |

|

|

Blogs

How can I save when I don’t have money?

How can I save when I don’t have money? This is a question we often hear in our financial coaching work, and for good reason. Read

FEPS program is transforming lives

The right support and advice can make all the difference for people living on low incomes.

Read

|

|

Highlights from the Field

|

|

What’s new for the 2017 tax filing season

This tax filing season, Canada Revenue Agency has made many important changes and improvements to services, benefits, and credits for Canadians. Here’s what you need to know. Read |

|

|

|

|

Community Financial Counselling Services to expand access to tax benefits

Prosper Canada is excited to introduce Community Financial Counselling Services (CFCS) as a Financial Empowerment Champion (FEC). CFCS is a non-profit credit counselling agency based in Winnipeg that provides a variety of affordable and accessible financial counselling/financial literacy services and programs for individuals across the province of Manitoba for more than 40 years. Read |

|

|

|

|

ABLE Financial Empowerment Conference postponed to 2018

For those of you anxiously awaiting dates for the next ABLE Financial Empowerment conference please be advised that the conference will be taking place in the spring of 2018. We will provide further updates on the host organization, location and conference theme in the coming months. Read |

|

|

|

Poll

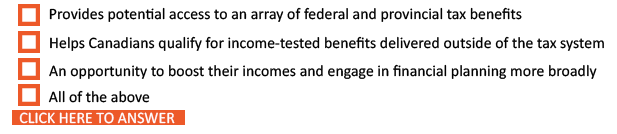

How do Canadians living on a low income benefit from income tax filing?  |

|

Upcoming Events

|

March 30, 2017 |

In-person Registered Disability Savings Plan (RDSP) workshop

Plan Institute is hosting an in-person RDSP workshop on March 30 from 10:00 a.m.-2:00 p.m. to share the ins-and-outs of the RDSP. Attendees will learn how to become eligible, open, manage and benefit from an account. Read |

|

|

April 4-6, 2017 |

Cities reducing poverty: When business is engaged

Vibrant Communities Canada and the City of Hamilton welcome you to join the third annual poverty reduction summit on April 4-6, 2017 in Hamilton, Ontario. Read |

|

|

April 19-20, 2017 |

Rethinking access: When non-traditional is the new normal

The Higher Education Quality Council of Ontario's seventh annual conference will examine the systems, programs and strategies that lead to greater postsecondary participation, retention and attainment. Read |

|

|

November 2-3, 2017 |

National conference on financial literacy

Save the date for the Financial Consumer Agency of Canada's (FCAC) fifth National Conference on Financial Literacy, November 2 - 3, 2017 in Montréal, QC. For more information, contact FCAC at conferenceinfo@fcac.gc.ca.

| |

Donate to Prosper Canada

Connect

|

Contact Us

60 St. Clair Avenue East,

Suite 700,

Toronto, Ontario M4T 1N5

Tel: 416 665 2828

Toll free: 1 877 568 1571

info@prospercanada.org |

|

|